How Licensed Money Lenders Can Help Your Investment?

They are basically associations or individuals who offer you personal loans to the individuals who need further money related interest so as to build up their independent company. They will give that underlying money out you have to dispatch a business when you don’t yet have money. This is a phenomenal option for individuals who are attempting to discover approaches to develop their independent company just as some different undertakings. Then again, Private Money Lenders generally experience a gigantic hazard when loaning capital. Their endeavour is ordinarily considered profoundly theoretical and they know that as there is a once in a lifetime opportunity with respect to financing organizations or speculation, there is likewise a comparable level of hazard concerned. On the off chance that you accept that your endeavour will be declined by the banks, or maybe when had been dropped, you can ordinarily utilize Private Money Lenders to give budgetary help through loans.

Flexibility

Furthermore they offer you more affordable rates, in any case, you should consider that the costs and furthermore the terms vary contingent upon the degree of danger of the endeavour. They will give choices to intrigue instalments from month to month, quarterly or maybe yearly. It is prudent to look at the specific phrasing with the legal money lender. One more extraordinary factor is the way that they can likewise offer you streak money and furthermore money that you may need only for a couple of days. This is an incredible arrangement when you find a wise speculation yet don’t have the money for it at that point. Obviously you would likewise need to take care of it sooner, so you have to ensure how the speculation can give a truly beneficial return in such a brief timeframe.

Necessities

The preferred position for you should you be searching for a loan and were declined by banks is the way that they require little record when contrasted with your typical home loan specialist and budgetary foundations just as pretty much some other loan organization. For the most part, pretty much all that you have to give are.

- FICO rating

- Verification of Income

- Financial balance

Indeed, credit standing is looked at, yet that doesn’t infer they won’t flexibly a loan on the off chance that your credit reputation is not exactly perfect. They for the most part test it to assess the hazard level of their own speculation. Albeit some need an initial instalment, it is normally very phenomenal. This is a decent scene to use for different speculation and business ventures. Anyway on account of the hazard concerned, it is likewise shrewd to comprehend the necessities of the lenders. They give an extraordinary, typically final hotel, answer for speculators, in addition to they are best kept accessible.

You May Also Like

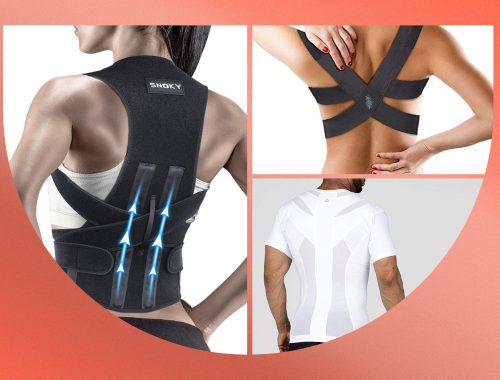

Unlock Your Potential with a Back Straightener: The Key to Confidence and Comfort

October 8, 2023

Nostalgia To Know About Singapore Photobooth

September 23, 2023